ข่าวจากสื่อสิ่งพิมพ์และข่าวแจ้งสื่อมวลชน

Steel-related stocks tipped as prices rise

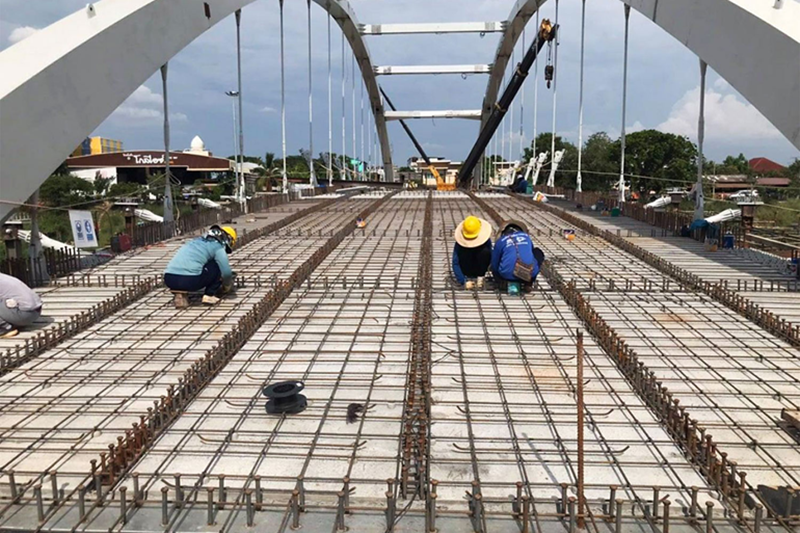

Bualuang Securities (BLS) recommends investing in steel and construction material stocks as steel prices surged for the fifth consecutive month in May in a rally that is expected to extend until the second half of the year.

The Ministry of Commerce reported the latest steel product price index for May at 120.7, the highest in 13 years. It rose 7% from April and 47% from the same period last year.

Entrepreneurs in the industry said steel prices will continue to rise in June and should remain at this level at least until the end of August.

If their speculation is correct, the average steel price in the second quarter will rise about 50% from the same period last year and 10% from the first quarter of this year.

Heineken banks on tournament drive

Order for prosecution in WEH share dispute issued

Boeing's New Air Force One Jets Could Arrive Late, Cost More

BLS recommends investments in construction and material stocks, claiming they are good options for investors who are looking to invest in steel stocks which are normally highly volatile.

Historical statistics indicate that prices of all commodity types, including steel, will rise significantly in the early stages of the economic recovery cycle, according to BLS research.

BLS expects some firms will benefit from the positive sentiment regarding commodity prices, especially steel-related companies such as Siam Global House Plc (GLOBAL), Dohome Plc (DOHOME), Home Product Center Plc (HMPRO) and Central Retail Corporation Plc (CRC), which will report good performance this quarter.

Stock picks from the group are HMPRO and CRC as their share prices remain low.

According to data from the Stock Exchange of Thailand, commodity and industrial stocks that benefited from the global economic recovery rose significantly in April.

Commodity, energy and petrochemicals, consumer goods, steel and rubber stocks, including their indices are expected to continue rising in May.

For the first five months of the year, the industrial index recorded the highest growth in return, rising 22.7% while the agricultural and food index went up 16%, the consumption index increased 14.1% and the SET Index rose 10%.

ที่มา : www.bangkokpost.com